In 2018, Paul Romer won Noble for his long-standing work on how investments fuels microeconomic growth. His words of caution were- Quit seeing research and development (R&D) as optional spending. Champion a new approach: turn your development costs into assets.

It was one of those wakeup calls for engineering leadership to embrace cost capitalization, and streamline engineering expenses.

Fast forward to 2023, software companies are adopting aggressive growth goals. For engineering leaders, the top financial hurdle to hit these goals revolves around dissecting engineering expenses and pinpointing where value truly originates. Enter R&D cost capitalization, a strategic avenue to tackle this challenge head-on.

What is R&D Cost Capitalization?

R&D cost capitalization is a legal accounting practice where software R&D costs, like FTE wages, and software licenses, are listed as investments, rather than an expense. In simpler terms, you're not just spending money; you're investing in your company’s future.

Today, every engineering team is working on the next big thing, and software development demands resources - be it time, or scientific manpower. These development costs can run in millions, often costing upto 63% of a project’s budget- making their financial sustainability a center point of C-suite discussions. While a significant portion is recognized as expenses, R&D cost capitalization helps turn some immediate expenditures into long-term, strategic costs.

The cost capitalization framework is solidly outlined under the International Financial Reporting Standards (IFRS) and the US Generally Accepted Accounting Principles (GAAP) regulations. However, as of now, GAAP has stayed silent on the proportion of software expenses eligible for capitalization. Nevertheless, over the past half-decade, the US has successfully capitalized approximately 17% of their expenditures, with an eye on capitalizing an additional 12%.

Benefits of Research and Capitalizing Software Development Costs

Continuous innovation is the lifeblood of engineering teams today. It requires resources to thrive, and cost capitalization as a financial strategy makes it achievable. Here are some reasons why engineering teams should adopt R&D cost capitalization:

- Adopting R&D cost capitalization enables companies to treat certain strategic costs as assets instead of keeping them under the profit and loss (P&L) section of their balance sheets.

- That way, balance sheets create a more accurate representation of an org’s financial health, and they can distribute their costs over time, avoiding a hefty one-time hit in a fiscal year. This might attract investors and stakeholders, showing them the value created for the company's future.

- These costs are spread using the straight-line method over a period of two to five years, to create a revenue-time continuum for the developed product.

- Organizations with higher R&D assets experience increased profitability. Reported profits have seen a jump of 14% after companies began to capitalize their R&D expenses.

- Capitalizing R&D costs acknowledges that innovation is an investment, not just an expense. It aligns financial reporting with the reality that these expenditures can yield returns beyond the current fiscal year.

- Capitalizing some percentage of software costs comes handy in leveraging tax incentives, and effectively streamlining Ebitda (earnings before interest, tax, depreciation and amortization). A higher Ebitda translates into better company financials and higher profits in books.

- According to a recent Livingstone analysis, the average EBITDA margin settles at approximately -6% after factoring in the R&D cost capitalization. However, this figure drops further to -8.5%, when R&D costs are treated as regular expenses.

Financial clarity is a must for engineering leaders. Or it is becoming more so now because dollars don’t come in easy. Capitalizing R&D costs translates into effectively assessing project RoIs. This informed decision-making can lead to allocating resources to initiatives with higher potential– paving the way for engineering success.

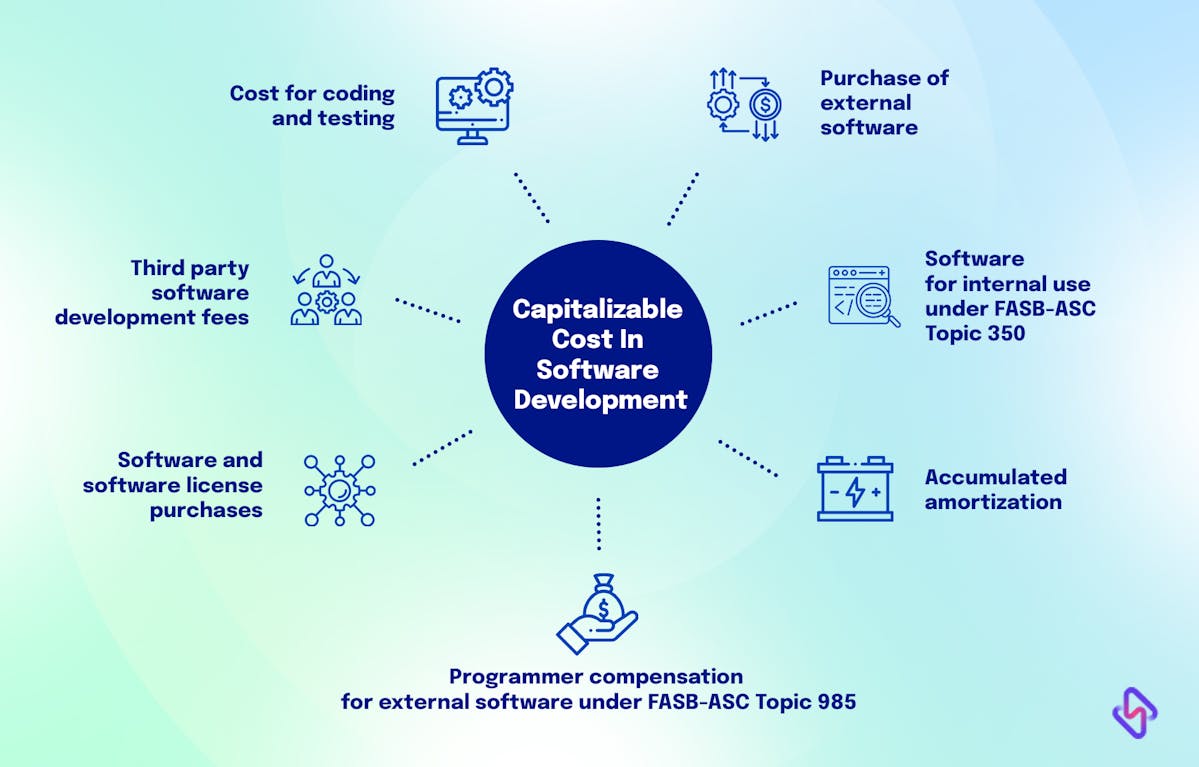

Software Costs That Qualify for Capitalization

Not all expenses can be transformed into assets, and the GAAP rules have been pretty clear about what qualifies for cost capitalization.R&D costs must meet certain criteria to earn their spot as an asset on the balance sheet:

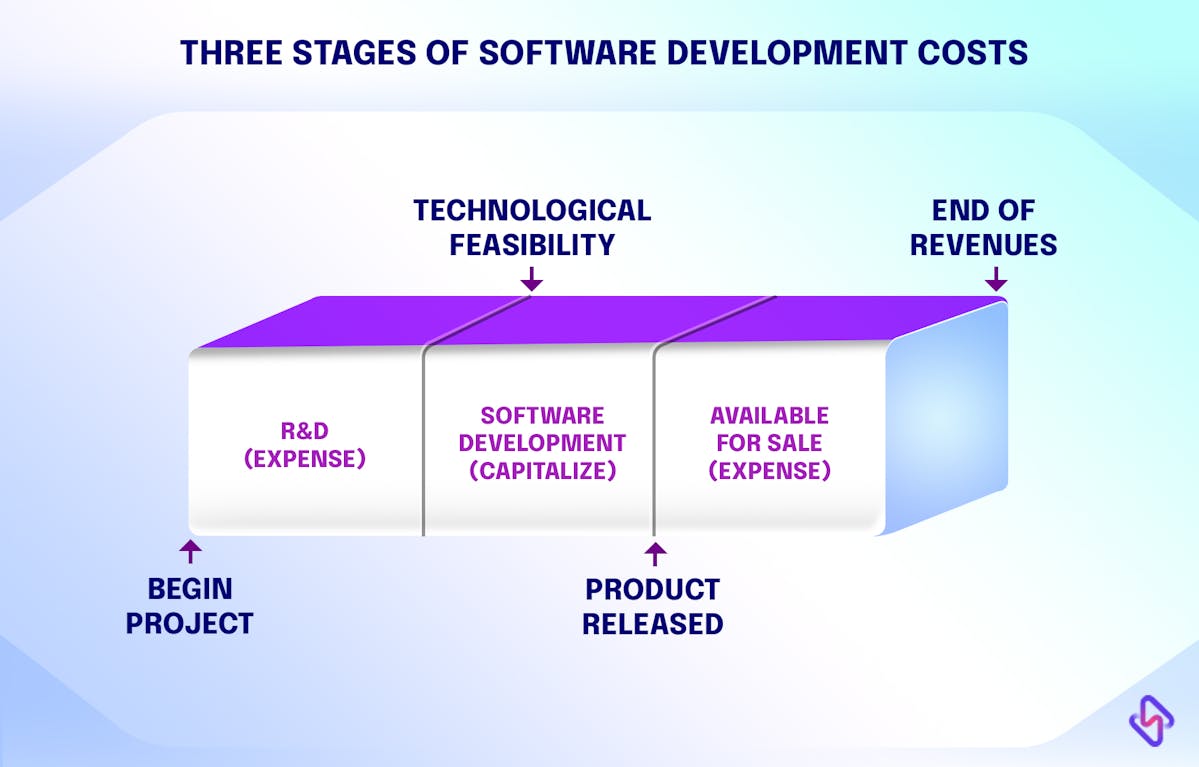

- Technology feasibility: The Capitalizable costs must translate into a tangible product or process.

- Intent to complete: A clear commitment snowballs into a well-defined plan, and filters out half-baked endeavors.

- Economic potential: Go-to market projections, and proof that the product will yield financial returns down the line.